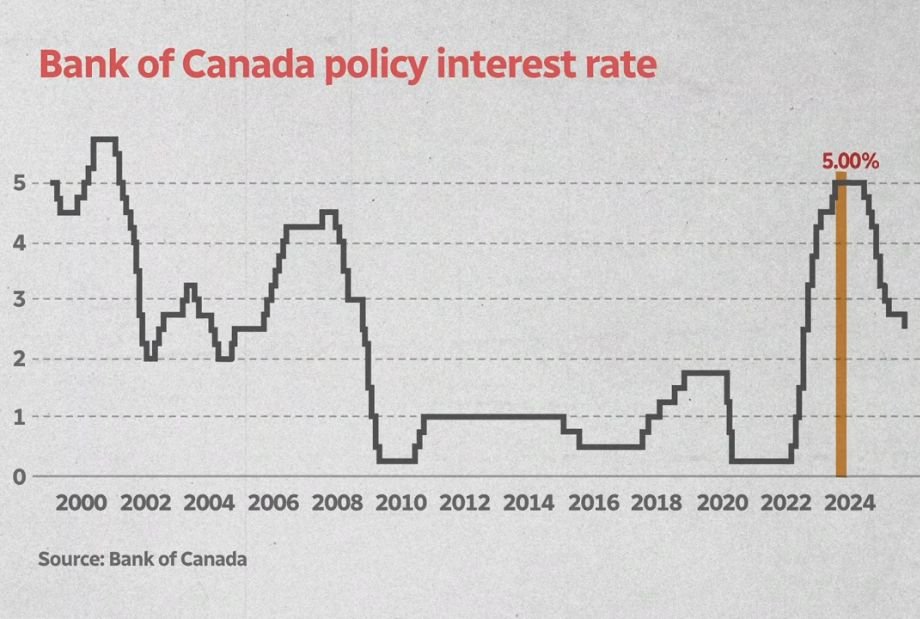

When the Bank of Canada announced a cut in its key interest rate, it may have looked like just another technical economic move. But behind that small shift lies a much bigger story about where Canada’s economy is heading and how Canadians might feel it in their daily lives.

Why Cut Rates Now?

Central banks don’t lower rates because things are going great. They do it when growth is slowing, businesses are struggling, and households are under pressure. And that’s the picture in Canada today.

The economy has been shrinking, job growth has stalled, and trade tensions with the United States are weighing heavily on exports. Inflation isn’t running wild in fact, it’s close to the Bank’s target but the real concern is that growth has lost momentum.

A Balancing Act

Governor Tiff Macklem described the move as a cautious step. Tariffs from the U.S. have hurt Canadian industries, and businesses are holding back on investment. At the same time, the Bank wants to prevent costs of living from rising too quickly. That means moving carefully, trying to strike a balance between stimulating growth and keeping inflation under control.

What It Means for Canadians

For households, a lower rate could bring some relief on mortgages and loans, though it won’t solve the housing affordability crunch. For workers, the outlook is mixed: lower rates might help businesses hold onto jobs, but a sluggish global economy could still mean layoffs ahead. For savers, lower rates make it harder to earn interest on deposits, which can feel like a squeeze.

The Politics of the Moment

All of this is unfolding just as Ottawa prepares its next federal budget. The government has signaled it’s ready to run a large deficit to invest in infrastructure, housing, and industrial projects. The idea: spend now to strengthen the economy for the future.

But this comes with political risk. Canadians are already worried about affordability, rising costs, and job security. Convincing people to accept higher deficits today in exchange for long-term benefits tomorrow is a tough sell. Opposition voices are already framing the spending as reckless.

Looking Ahead

Canada is at an inflection point. The economic challenges are real: weak growth, global uncertainty, and household financial stress. The central bank can buy some breathing room with lower rates, but it can’t solve everything.

That leaves the federal government with the bigger task: to show Canadians not just a vision of transformation down the road, but concrete reasons to believe things will get better soon.

✨ Takeaway: The Bank of Canada’s rate cut is more than a number — it’s a warning sign. How policymakers respond now will shape not just Canada’s economy, but also the trust Canadians place in their leaders.